The New Era of Intelligent Workflows

Enterprise data today flows through more channels than ever before. Walk into any organization, and you'll find teams juggling PDFs from clients, forms submitted through web portals, emails packed with attachments, and conversations happening through chatbots and support systems. Each channel brings its own format, structure, and processing requirements. What started as multiple solutions to reduce friction has created a new problem: fragmentation.

Most enterprises have built point solutions for each input type. They've got sophisticated form builders that adapt to user needs, PDF processors that can extract structured data from complex documents, email systems that route and categorize messages, and chatbots that handle routine inquiries. These tools work well within their individual domains. A mortgage application might flow smoothly through an online form, while vendor invoices get processed efficiently through PDF extraction systems. But here's where things get complicated.

When a customer submits part of their information through a web form, follows up via email with additional documents, and then calls to clarify details through a support chat, that single transaction fragments across multiple systems. The form data sits in one database, the email attachment gets processed separately, and the chat conversation remains in yet another platform. Someone has to manually piece these fragments together to get the complete picture.

This fragmentation isn't just an operational headache. It creates real business risks. Compliance teams struggle to maintain audit trails across disconnected systems. Customer service representatives can't access complete interaction histories. Decision-making slows down because critical information gets trapped in silos. And as enterprises grow, these problems multiply.

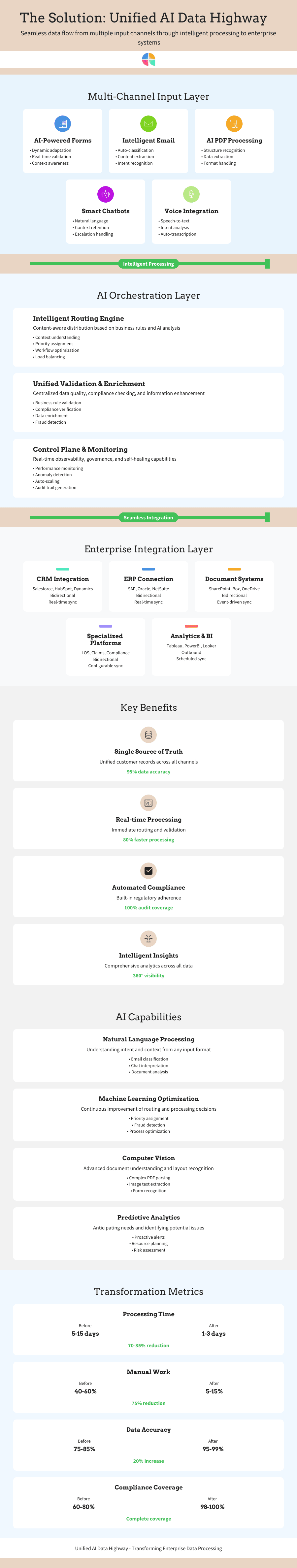

The next evolution in enterprise automation isn't about making individual channels more efficient. It's about creating a unified intelligence layer that can handle any input type, from any source, and route it seamlessly through the same processing pipeline. Think of it as building a data highway where information can flow smoothly regardless of how it enters the system.

This vision goes beyond simple integration. It's about creating an AI-powered orchestration layer that understands context, maintains consistency, and adapts to changing business needs. When done right, it transforms how enterprises handle information, turning disconnected processes into intelligent workflows that can scale with business growth.

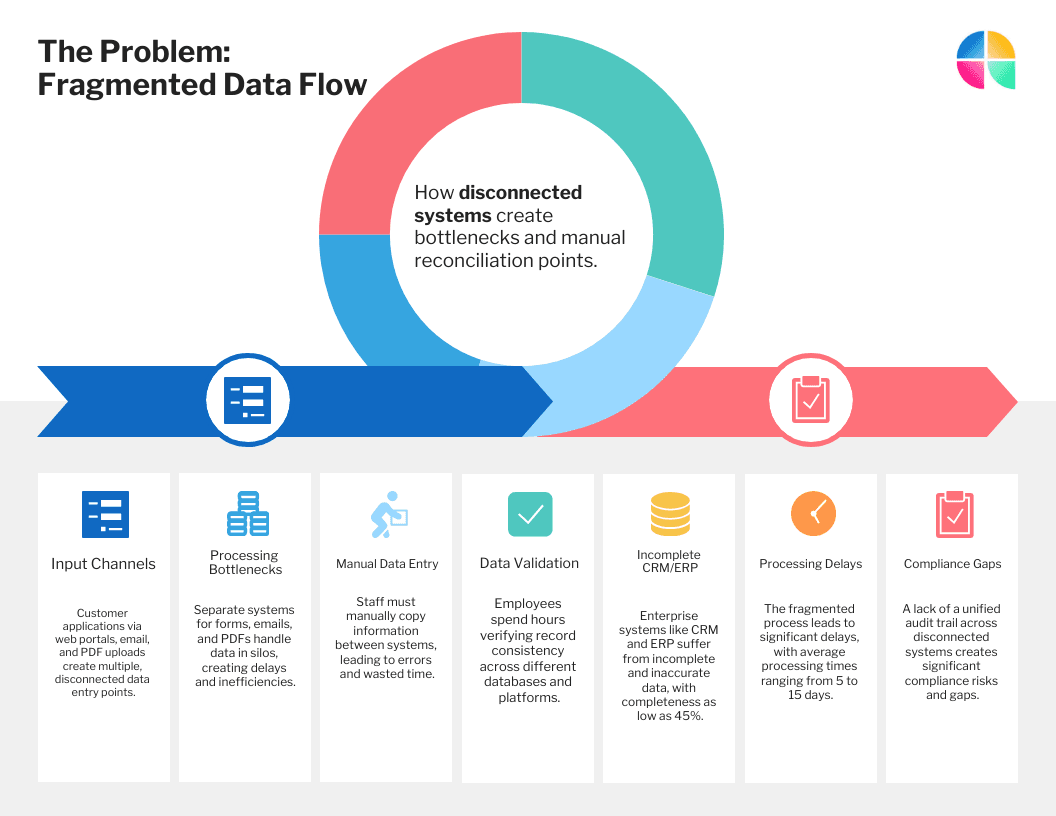

Why Fragmentation Hurts Enterprises

The cost of fragmented data intake shows up in unexpected places. Take a typical vendor onboarding process at a mid-sized company. New suppliers might submit their information through an online portal, but they often follow up with additional certifications via email, clarify requirements through phone calls that get logged in CRM notes, and sometimes even fax documents that need manual scanning and filing.

Each touchpoint creates a separate record. The procurement team sees the portal submission, accounts payable processes the emailed tax documents, and legal reviews the contract terms that arrived through a different channel. By the time someone needs to verify the complete vendor profile, they're hunting through multiple systems, trying to piece together a coherent picture. What should take minutes stretches into hours.

This fragmentation creates three major problems that compound over time. First, manual reconciliation becomes a full-time job for many employees. Teams spend significant portions of their day copying information between systems, verifying that records match, and hunting down missing pieces of information. These activities don't add value, but they're necessary because the systems can't communicate effectively with each other.

Second, data silos lead to duplicate records and compliance gaps. When customer information exists in multiple places, it's almost inevitable that some records will become outdated or inconsistent. A client's address might be current in the CRM but outdated in the accounting system. Insurance information could be filed correctly in one database but missing from another. These inconsistencies create compliance risks, especially in regulated industries where accurate record-keeping is mandatory.

Third, the time from intake to action stretches longer than it should. When information arrives through multiple channels, it often sits in queues waiting for manual processing. Someone has to review each submission, determine where it belongs, and route it to the appropriate system or team member. During peak periods, this creates bottlenecks that slow down critical business processes.

Consider what happens during a loan application process. The applicant submits their initial information through an online form, which feeds into the loan origination system. They email their pay stubs and tax returns, which might get processed through document management software. They upload bank statements through a secure portal, and these files end up in a different repository. When the underwriter needs to review the complete application, they're accessing three or four different systems, each with its own interface and search functionality.

The delay isn't just about convenience. In competitive markets, processing time directly impacts customer satisfaction and business outcomes. Mortgage applicants who don't hear back quickly often shop around with other lenders. Insurance claims that sit in processing queues create frustrated customers who might switch providers. Vendor payments that get delayed due to document processing issues can damage important business relationships.

These problems get worse as enterprises grow and add more systems. What starts as a manageable collection of specialized tools gradually becomes a complex web of integrations, manual processes, and workaround procedures. Teams develop informal knowledge about which systems contain which information, but this knowledge isn't documented or easily transferable. When key employees leave, institutional knowledge walks out the door with them.

The financial impact extends beyond operational inefficiency. Enterprises often discover that they're paying for multiple software licenses that perform overlapping functions. They might have three different document processing systems, two customer communication platforms, and several database solutions that store similar information. The total cost of ownership for these fragmented systems often exceeds what a unified solution would require.

More importantly, fragmentation limits an organization's ability to leverage data for strategic insights. When information is scattered across multiple systems, it becomes difficult to analyze patterns, identify trends, or make data-driven decisions. Customer journey analytics become nearly impossible when touchpoints are recorded in different formats across various platforms. Operational efficiency metrics can't be calculated accurately when process data lives in separate silos.

The compliance challenges deserve special attention. Regulated industries must maintain complete audit trails for customer interactions, financial transactions, and operational processes. When information flows through fragmented systems, creating these audit trails requires manual effort and introduces opportunities for errors. During regulatory examinations, teams spend weeks assembling documentation from multiple sources instead of generating comprehensive reports from unified systems.

Security concerns also multiply with fragmentation. Each system requires its own access controls, monitoring, and security protocols. Information might be secure within individual platforms but become vulnerable during transfers between systems. Data classification becomes more complex when the same information exists in multiple formats across different repositories.

The Building Blocks Already in Place

The foundation for unified data processing already exists in today's enterprise software landscape. Organizations have invested heavily in specialized AI-powered tools that excel within their particular domains. These building blocks work remarkably well for their intended purposes, but they operate as separate islands of functionality rather than connected components of a larger system.

AI-powered forms represent perhaps the most mature building block in this ecosystem. Modern form systems adapt dynamically to user responses, presenting relevant fields based on previous answers and pre-filling information from available data sources. They can validate entries in real-time, catch common errors before submission, and even guide users through complex multi-step processes with contextual help and suggestions.

These intelligent forms go far beyond simple data collection. They understand business rules and can enforce policy requirements during the input process. For example, an insurance application form might automatically adjust coverage options based on the applicant's location, occupation, and risk profile. A vendor registration form could dynamically request additional documentation based on the company's size, industry, and geographic location. This contextual awareness reduces errors and improves data quality right at the point of entry.

PDF processing represents another sophisticated building block that has matured significantly in recent years. Advanced AI systems can now extract structured data from complex documents regardless of format, layout, or quality. They can identify key information like dates, amounts, names, and addresses even when these appear in different locations within various document types. More importantly, they can understand document context and relationships between different pieces of information.

Modern PDF processing systems don't just extract text; they understand document structure and meaning. They can differentiate between header information and body content, identify tables and their relationships, and even recognize when information spans multiple pages. For financial documents, they can calculate totals, identify discrepancies, and flag unusual entries for manual review. For legal contracts, they can extract key terms, identify parties and obligations, and highlight non-standard clauses.

Email processing has evolved into a powerful AI-driven system capable of understanding context, intent, and urgency. These systems can automatically classify incoming messages, route them to appropriate team members, and even draft initial responses based on the content and sender. They understand business relationships, can identify escalations that require immediate attention, and maintain conversation threads across multiple interactions.

Advanced email processing systems can extract actionable information from message content and attachments. They might identify purchase orders embedded in email text, extract shipping information from forwarded messages, or recognize policy changes that need to be reflected in customer records. When combined with natural language processing, these systems can understand subtle nuances in communication and respond appropriately to different contexts and relationships.

Chatbot interfaces have become sophisticated conversational platforms that can handle complex multi-turn interactions while maintaining context throughout extended conversations. Modern chatbots understand natural language, can access multiple data sources to answer questions, and seamlessly escalate to human agents when situations require personal attention. They can guide users through complex processes, validate information in real-time, and provide personalized recommendations based on user history and preferences.

These conversational interfaces excel at capturing information in unstructured formats and transforming it into structured data for downstream processing. A customer might describe their insurance claim in casual conversation, mentioning dates, locations, and circumstances in a natural flow. The chatbot can extract key details, ask clarifying questions to fill gaps, and ultimately produce a complete, structured claim record ready for processing.

Each of these building blocks has reached a level of sophistication that would have seemed impossible just a few years ago. They incorporate machine learning models trained on vast datasets, understand context and business rules, and adapt to user behavior and preferences. Within their individual domains, they've dramatically reduced friction and improved user experiences.

The limitation isn't in the capability of these individual components, but in how they work together. A customer might start an insurance claim through a chatbot, submit supporting documentation via email, and complete additional forms through a web portal. Each interaction produces high-quality, structured data within its respective system. But connecting these interactions into a single, coherent process still requires manual intervention and custom integration work.

This is where the opportunity lies. The building blocks are mature and proven. The AI capabilities are sophisticated and reliable. What's missing is an orchestration layer that can seamlessly connect these components and create unified workflows that span multiple input channels. Instead of treating each component as a standalone solution, the next evolution involves combining them into an integrated platform that maintains the strengths of each individual building block while eliminating the friction between them.

The Vision: A Unified AI Data Highway

Imagine a system where information flows seamlessly regardless of how it enters your organization. A customer could start a mortgage application through your website, email additional documents from their phone, clarify requirements through a chat conversation, and submit final forms through a mobile app. Instead of creating four separate records that need manual reconciliation, all these interactions would automatically merge into a single, complete application file that moves smoothly through your processing pipeline.

This unified data highway operates on three fundamental principles that transform how enterprises handle information. The first principle involves seamless routing based on content and context rather than input channel. When information arrives, the system immediately analyzes what it contains, understands its business purpose, and routes it to the appropriate processing workflow. A bank statement uploaded through email gets the same intelligent processing as one submitted through a web form. A service request mentioned in a chat conversation triggers the same workflow as one submitted through a formal ticket system.

This routing intelligence goes beyond simple rule-based systems. Advanced AI models understand context, relationships, and business intent. They can recognize when a casual email inquiry actually represents a formal service request, when an uploaded document contains information that updates multiple customer records, or when a chat conversation reveals compliance issues that need escalation. The system doesn't just move data; it understands what the data means and what actions it should trigger.

The second principle centers on centralized validation, enrichment, and compliance checking that applies consistently across all input channels. Whether information arrives through a structured form or an unstructured email conversation, it goes through the same quality assurance processes. Data gets validated against business rules, enriched with information from connected systems, and checked for compliance requirements before moving forward in the workflow.

This centralization eliminates the inconsistencies that plague fragmented systems. Customer addresses get validated against the same database whether they're entered through a form or extracted from a PDF. Financial information receives the same fraud checks regardless of submission method. Compliance requirements are enforced uniformly across all channels, ensuring that regulatory standards are met consistently throughout the organization.

The enrichment capabilities add significant value beyond basic validation. When a customer submits partial information through any channel, the system can automatically fill in missing details from existing records, external databases, or connected systems. A vendor's tax ID number might automatically populate their industry classification, regulatory requirements, and payment terms based on established business rules and historical data.

The third principle establishes API-first integration that connects seamlessly with ERP, CRM, loan origination systems, and other core enterprise platforms. Instead of building custom integrations for each system combination, the unified data highway provides standardized connectors that can adapt to different enterprise architectures. This flexibility allows organizations to maintain their existing technology investments while gaining the benefits of unified data processing.

These API connections work bidirectionally, not just pushing data into enterprise systems but also pulling information back to enrich the input process. When a customer starts an application, the system can immediately access their history, preferences, and current status from connected systems. This context allows for personalized experiences and intelligent pre-filling that reduces customer effort and improves data accuracy.

The practical implications of this unified approach extend far beyond operational efficiency. Customer experiences improve dramatically when all their interactions connect seamlessly. They don't need to repeat information, worry about which channel to use for different types of requests, or wonder whether their previous submissions were received and processed. Every touchpoint builds on previous interactions, creating a continuous and coherent relationship.

For enterprise teams, this unification eliminates much of the manual work that currently consumes their time. Instead of hunting through multiple systems to assemble complete customer records, they have immediate access to comprehensive, up-to-date information. Instead of manually routing documents and messages to appropriate team members, the system handles intelligent distribution based on content, urgency, and business rules.

The compliance benefits are equally significant. Audit trails become comprehensive and automatic, covering all customer interactions regardless of channel. Regulatory reporting can be generated directly from the unified system without manual data assembly. Data retention and privacy policies apply consistently across all information, reducing compliance risks and simplifying governance procedures.

From a strategic perspective, unified data processing enables entirely new capabilities. Real-time analytics become possible when all information flows through the same processing pipeline. Customer journey mapping can track interactions across every channel. Operational bottlenecks become visible and measurable. Business intelligence extends across the entire customer lifecycle instead of being limited to individual system silos.

This vision isn't about replacing existing systems but rather about creating an intelligent orchestration layer that maximizes the value of current technology investments. Organizations can continue using their preferred CRM, ERP, and specialized software while gaining the benefits of unified data processing. The data highway becomes the connective tissue that transforms a collection of individual tools into an integrated, intelligent platform.

From Today to Tomorrow: Artificio's Roadmap

The transition from fragmented input channels to a unified data highway isn't a distant future concept. Artificio has already deployed the foundational components that make this vision possible. Today's implementations demonstrate the power of unified processing through real-world applications that are delivering measurable results for enterprise clients.

Currently available capabilities provide sophisticated processing for each major input type while maintaining the flexibility to integrate with existing enterprise systems. The AI forms platform adapts dynamically to user responses and business rules, creating intelligent data collection experiences that rival custom-built solutions. PDF processing handles complex documents with accuracy rates that exceed manual processing while operating at scale that would be impossible with human resources alone.

Email automation systems currently manage thousands of interactions daily, automatically classifying messages, extracting actionable information, and routing requests to appropriate team members. Chatbot interfaces handle routine inquiries while seamlessly escalating complex issues to human agents with complete context and conversation history. These individual capabilities work well within their domains and have proven their reliability through extensive production use.

The next phase of development focuses on deeper integration between these components and the introduction of centralized orchestration capabilities. The control plane represents the first major advancement in this direction. This system provides comprehensive observability across all input channels, allowing operations teams to monitor data flow, identify bottlenecks, and track performance metrics in real-time.

The control plane goes beyond basic monitoring to include intelligent governance capabilities. It can automatically detect anomalies in data patterns, identify potential compliance issues before they become problems, and even implement self-healing procedures for common operational challenges. When a particular input channel experiences high volumes that might cause processing delays, the control plane can automatically adjust resource allocation to maintain service levels.

Self-healing capabilities represent a significant advancement in operational reliability. The system can detect when document processing queues are backing up and automatically spin up additional processing capacity. It can identify when integration connections are experiencing latency and switch to backup pathways. When data validation rules change, it can automatically update processing workflows across all input channels without requiring manual intervention.

Workflow intelligence introduces sophisticated decision-making capabilities that combine rule-based logic with large language model reasoning. This hybrid approach allows the system to handle both structured business processes and unstructured decision-making scenarios. For routine situations with clear business rules, the system processes information automatically. For complex or unusual scenarios, it can leverage advanced AI reasoning to determine appropriate actions while maintaining human oversight for critical decisions.

These intelligent workflows adapt to changing business conditions and learn from operational experience. When new types of documents or requests start arriving through input channels, the system can recognize patterns and suggest new processing workflows. When existing rules prove insufficient for handling edge cases, it can recommend updates or escalate situations to human decision-makers with comprehensive context and suggested actions.

Enterprise connectors represent the final component needed for comprehensive data highway implementation. These pre-built integrations provide plug-and-play connectivity with major enterprise platforms including Salesforce, SAP, Oracle, Microsoft Dynamics, and hundreds of other business systems. Instead of requiring custom integration development, organizations can configure these connectors through intuitive interfaces that handle complex technical details automatically.

The connector architecture is designed for flexibility and extensibility. Organizations with custom or specialized systems can use the platform's API framework to build their own integrations using the same patterns and capabilities as the pre-built connectors. This approach ensures that unique business requirements don't become barriers to unified data processing implementation.

Future capabilities will extend workflow intelligence to include predictive analytics and proactive recommendations. The system will identify patterns that indicate potential issues before they occur, suggest process improvements based on historical data, and recommend automation opportunities that can further reduce manual work. Machine learning models will continuously optimize routing decisions, processing priorities, and resource allocation based on real-world performance data.

The roadmap also includes advanced collaboration features that allow multiple team members to work with the same information simultaneously while maintaining data integrity and audit trails. Version control, approval workflows, and delegation capabilities will ensure that complex processes can be managed efficiently even when they involve multiple stakeholders and decision points.

Integration capabilities will expand to include real-time data synchronization with external platforms, allowing the unified data highway to serve as a central hub for information that needs to be accessible across multiple systems. This synchronization will be bidirectional and intelligent, ensuring that updates made in any connected system are reflected appropriately across all relevant platforms.

Use Cases for the Unified Data Highway

The practical applications of unified data processing become most apparent when examining specific industry scenarios where fragmented systems currently create operational challenges. These use cases demonstrate how the data highway approach transforms complex, multi-step processes into streamlined workflows that improve both efficiency and user experience.

Mortgage origination represents one of the most complex data-intensive processes in financial services. Loan applications typically involve dozens of documents, multiple verification steps, and coordination between various stakeholders including borrowers, real estate agents, appraisers, and underwriters. Currently, this information arrives through multiple channels and gets processed by different systems, creating numerous opportunities for delays and errors.

In a unified data highway implementation, the mortgage process becomes dramatically more efficient. A prospective borrower might start their application through an online form that captures basic information and preferences. The system immediately begins collecting supporting data from connected sources, pre-filling information from credit bureaus, employment databases, and financial institutions. When the applicant uploads tax returns and bank statements through email or mobile app, the system automatically extracts relevant information and validates it against the initial application data.

As additional documentation arrives through various channels, the system maintains a complete, real-time view of the application status. When the real estate agent submits property information, it automatically triggers appraisal scheduling and title searches. When income verification arrives from employers, it immediately updates underwriting calculations and identifies any discrepancies that need attention. The underwriter sees a complete, organized file instead of hunting through multiple systems to assemble the necessary information.

This unified approach reduces loan processing times from weeks to days while improving accuracy and compliance. Borrowers receive real-time updates on their application status and know exactly what additional information might be needed. Loan officers can focus on relationship building and problem-solving instead of administrative tasks and data entry.

Vendor onboarding and compliance processes present similar challenges in most enterprises. New suppliers must provide extensive documentation including business licenses, insurance certificates, financial statements, and compliance certifications. This information typically arrives through email, gets uploaded to various portals, and requires manual verification against multiple databases and regulatory requirements.

A unified data highway transforms vendor onboarding into a streamlined process that maintains compliance while reducing administrative burden. When potential vendors submit initial information through any channel, the system immediately begins collecting supporting data from public databases, industry associations, and regulatory agencies. It can verify business licenses, check insurance coverage, and validate financial information automatically.

As additional documentation arrives, the system maintains a complete compliance profile and automatically flags any missing requirements or potential issues. When insurance certificates are near expiration, it proactively notifies both the vendor and internal compliance teams. When regulatory requirements change, it automatically updates vendor requirements and initiates re-verification processes where necessary.

This approach reduces vendor onboarding time from months to weeks while ensuring comprehensive compliance documentation. Procurement teams can focus on strategic supplier relationships instead of administrative paperwork. Compliance officers have real-time visibility into vendor status across the entire supply chain.

Healthcare claims automation represents another area where unified data processing creates significant value. Medical claims involve complex documentation from multiple sources including healthcare providers, patients, insurance companies, and regulatory agencies. Currently, this information gets processed through separate systems that often require manual reconciliation and verification.

With unified processing, claims information flows seamlessly from initial submission through final payment. When providers submit claims electronically, the system automatically validates medical codes, checks policy coverage, and identifies potential fraud indicators. When patients submit additional documentation through patient portals or mobile apps, it automatically associates with the relevant claims and updates processing status.

The system can handle prior authorization requests, appeals, and adjustments as part of the same unified workflow. When new medical information arrives through any channel, it automatically updates relevant claims and triggers appropriate processing steps. Claims processors see complete, organized files instead of fragmented information scattered across multiple systems.

Legal contract processing showcases how unified data highways can handle highly unstructured information that requires significant human expertise. Contracts arrive in various formats, contain complex terms and conditions, and often require review by multiple stakeholders with different areas of expertise.

In a unified system, contracts submitted through any channel immediately undergo intelligent analysis that extracts key terms, identifies standard clauses, and flags unusual provisions for human review. The system can compare new contracts against approved templates, identify deviations from standard terms, and route different sections to appropriate subject matter experts.

As stakeholders review and comment on contracts, the system maintains complete audit trails and manages approval workflows. When changes are requested, it automatically updates relevant sections and notifies all stakeholders of modifications. Final contracts are automatically stored with appropriate metadata and linked to relevant business records in connected systems.

This unified approach reduces contract processing time while improving compliance and risk management. Legal teams can focus on high-value advisory work instead of administrative tasks. Business stakeholders have real-time visibility into contract status and can make informed decisions based on complete, up-to-date information.

Each of these use cases demonstrates the same fundamental transformation: complex, multi-step processes that currently require significant manual coordination become automated, intelligent workflows that operate seamlessly across multiple input channels. The result is faster processing, improved accuracy, better compliance, and enhanced user experiences for both internal teams and external stakeholders.

Why This Matters

The transformation from fragmented data processing to unified intelligent workflows represents more than an operational improvement. It fundamentally changes how enterprises interact with information and make decisions. Organizations that successfully implement unified data highways gain significant competitive advantages that compound over time and create lasting strategic value.

Efficiency improvements extend far beyond simple time savings. When information flows seamlessly through intelligent processing pipelines, teams can focus on high-value activities instead of administrative tasks. Customer service representatives spend more time solving problems and building relationships instead of hunting for information across multiple systems. Compliance officers can proactively manage risk instead of reactively assembling audit documentation. Operations managers can optimize processes based on real-time data instead of making decisions with incomplete information.

These efficiency gains create a virtuous cycle of improvement. As teams spend less time on routine data processing, they have more capacity to analyze patterns, identify opportunities, and implement process improvements. The unified data highway provides comprehensive visibility into operational patterns that were previously hidden across fragmented systems. This visibility enables data-driven decision making that continuously optimizes business performance.

Compliance benefits are particularly significant in regulated industries where documentation requirements are extensive and penalties for non-compliance can be severe. Unified data processing ensures that all information is captured, validated, and stored according to regulatory requirements regardless of how it enters the organization. Audit trails are comprehensive and automatically generated. Reporting requirements can be met with automated systems instead of manual data assembly.

More importantly, unified systems enable proactive compliance management instead of reactive documentation. The system can monitor changing regulatory requirements and automatically update processing workflows to maintain compliance. It can identify potential issues before they become problems and recommend corrective actions based on regulatory guidance and industry best practices.

Real-time visibility transforms how enterprises understand and manage their operations. When all information flows through unified processing pipelines, organizations gain comprehensive insights into customer behavior, operational performance, and market trends. Managers can identify bottlenecks as they develop, understand customer preferences as they evolve, and spot market opportunities as they emerge.

This visibility enables agile responses to changing business conditions. When customer preferences shift, organizations can quickly adapt their processes and offerings. When market conditions change, they can adjust their strategies based on real-time data instead of waiting for quarterly reports. When operational issues arise, they can implement corrective actions immediately instead of discovering problems during periodic reviews.

The strategic implications extend to how enterprises position themselves for future growth and market changes. Organizations with unified data processing capabilities can rapidly deploy new services, enter new markets, and adapt to changing customer expectations. They can experiment with new business models and measure results in real-time. They can scale operations efficiently without proportional increases in administrative overhead.

Perhaps most importantly, unified data highways position enterprises to take advantage of emerging AI capabilities as they become available. When information is properly structured and unified, it becomes much easier to apply advanced analytics, machine learning, and artificial intelligence tools. Organizations can leverage their data assets for predictive analytics, automated decision making, and intelligent process optimization.

This positioning becomes increasingly valuable as AI capabilities continue to advance. Enterprises with unified, high-quality data can quickly implement new AI tools and techniques. Those with fragmented systems face significant data preparation and integration challenges before they can leverage advanced AI capabilities. The data highway approach ensures that organizations are ready to take advantage of future innovations without major system overhauls.

The competitive advantages compound over time as unified systems enable continuous improvement and learning. Every customer interaction, every process execution, and every business decision generates data that can be used to optimize future performance. Organizations with unified data processing capabilities can learn faster, adapt more quickly, and serve customers more effectively than competitors with fragmented systems.

These advantages become more pronounced as business environments become more complex and competitive. Organizations that can respond quickly to customer needs, adapt efficiently to market changes, and operate with high levels of automation will outperform those that rely on manual processes and fragmented systems. The unified data highway approach provides the foundation for this competitive advantage.

From Vision to Reality

The transformation from fragmented data processing to unified intelligent workflows is already underway. Artificio stands at the forefront of this evolution, combining proven AI capabilities with innovative orchestration technology to create practical solutions that deliver immediate value while building toward a comprehensive data highway vision.

The path forward isn't about wholesale replacement of existing systems but rather intelligent integration that maximizes current technology investments while eliminating friction between different platforms. Organizations can begin this transformation gradually, starting with their most problematic data processing challenges and expanding unified capabilities as they prove their value.

Early implementations focus on connecting related processes that currently require manual coordination. A mortgage lender might begin by unifying their application intake process, ensuring that information submitted through web forms, emails, and mobile apps flows into the same processing pipeline. As this integration proves successful, they can expand to include document processing, verification workflows, and final approval processes.

This incremental approach allows organizations to realize benefits quickly while building confidence and expertise with unified processing concepts. Teams can adapt to new workflows gradually instead of managing large-scale system changes all at once. Business processes continue operating during implementation, ensuring continuity and minimizing disruption.

Artificio's role in this transformation combines technology platform development with implementation expertise and ongoing support. The platform provides the technical foundation for unified data processing, but successful implementations require deep understanding of business processes, integration requirements, and change management strategies.

The collaboration between Artificio and enterprise clients goes beyond traditional vendor-customer relationships. Organizations that participate in early implementations help shape product development priorities and influence future capability development. This collaborative approach ensures that the data highway platform continues evolving to meet real-world business requirements instead of pursuing theoretical capabilities that don't address practical challenges.

Future development roadmaps are driven by client feedback and emerging business needs rather than purely technical considerations. When multiple organizations identify similar processing challenges, those problems become priorities for platform development. When new regulations or market conditions create additional requirements, the platform evolves to address those needs.

This collaborative development approach accelerates innovation while ensuring practical relevance. Instead of developing features in isolation and hoping they meet market needs, Artificio works closely with enterprise clients to understand their challenges, prototype solutions, and refine capabilities based on real-world feedback.

The invitation for enterprise collaboration extends beyond early platform adoption to include strategic partnership opportunities. Organizations with complex data processing requirements can work directly with Artificio's development team to create specialized capabilities that address their unique needs while contributing to the broader platform evolution.

These partnerships create value for all participants. Individual organizations get customized solutions that address their specific requirements. The broader platform benefits from real-world testing and refinement that improves capabilities for all users. The entire ecosystem advances more quickly through shared learning and collaborative development.

The vision of fully unified data orchestration represents a fundamental shift in how enterprises handle information, but it's grounded in practical capabilities that are available today. Organizations don't need to wait for future developments to begin realizing the benefits of unified data processing. They can start with current capabilities and expand their implementations as additional features become available.

This practical approach to visionary goals ensures that the transformation from fragmented systems to unified data highways happens through steady, measurable progress rather than disruptive wholesale changes. Organizations can maintain operational continuity while building toward more intelligent, efficient, and responsive data processing capabilities.

The future of enterprise data processing is being built today through the collaboration between innovative technology providers and forward-thinking organizations willing to pioneer new approaches to persistent challenges. Artificio invites enterprises to join this transformation, contributing their expertise and requirements while gaining access to cutting-edge capabilities that will define the next generation of intelligent business operations.

The unified data highway isn't just a technological advancement; it's a new way of thinking about how information flows through organizations and how technology can serve human decision-making and customer relationships. Organizations that embrace this vision today will be positioned to lead their industries tomorrow, while those that delay risk falling behind as unified processing becomes the new standard for efficient, intelligent enterprise operations.