The integration of artificial intelligence (AI) with existing Loan Origination Systems (LOS) represents a transformative shift in the lending industry, promising to revolutionize how financial institutions process, evaluate, and approve loans. This comprehensive analysis explores the intricate relationship between AI technologies and traditional LOS platforms, examining both the theoretical foundations and practical implementations that drive this evolution in lending operations.

The lending landscape has undergone significant changes in recent years, driven by technological advancement and changing consumer expectations. Traditional loan origination processes, while structured and reliable, often struggle to meet the demands of modern lending operations, particularly in terms of processing speed, accuracy, and scalability. The integration of AI technologies presents a solution to these challenges, offering enhanced capabilities in data processing, risk assessment, and decision-making automation.

The Current State of Loan Origination Systems

Traditional loan origination systems serve as the backbone of lending operations, managing the entire lifecycle of loan applications from initial submission to final approval or rejection. These systems typically handle crucial functions such as document management, credit assessment, underwriting, and regulatory compliance. However, they often operate within the constraints of rule-based processing and manual intervention, leading to operational inefficiencies and potential bottlenecks in the lending pipeline.

Contemporary LOS platforms have evolved to incorporate various technological improvements, including digital document processing and automated workflows. Nevertheless, they frequently fall short in areas requiring complex pattern recognition, predictive analysis, and real-time decision-making capabilities. The processing of unstructured data from diverse sources remains a significant challenge for traditional systems, as they struggle to efficiently extract and analyze information from varied document formats and sources. Real-time risk assessment and fraud detection capabilities are often limited by the rigid nature of conventional rule-based systems, while dynamic adjustment of underwriting criteria requires extensive manual intervention. Furthermore, the ability to provide personalized loan product recommendations based on comprehensive applicant analysis remains largely unrealized in traditional systems, and regulatory compliance monitoring often relies heavily on manual oversight and periodic reviews.

The AI Advantage in Lending Operations

Artificial intelligence technologies, particularly machine learning and natural language processing, offer sophisticated solutions to the inherent limitations of traditional LOS platforms. By leveraging advanced algorithms and data analytics capabilities, AI-enhanced systems can significantly improve the efficiency and effectiveness of lending operations. These improvements manifest across multiple dimensions of the lending process, creating a more dynamic and responsive lending environment.

Machine learning models can analyze vast amounts of historical lending data to identify patterns and relationships that might escape human observation. This capability enables more accurate risk assessment and better prediction of loan performance. Natural language processing facilitates the automated extraction and analysis of information from unstructured documents, such as financial statements, tax returns, and employment verification documents. The synthesis of these technologies creates a more comprehensive and nuanced understanding of loan applications, leading to better-informed lending decisions.

Furthermore, AI systems can continuously learn and adapt from new data, allowing them to refine their accuracy and effectiveness over time. This adaptive capability is particularly valuable in the dynamic lending environment, where market conditions, regulatory requirements, and risk factors constantly evolve. The continuous learning process ensures that the system remains current with emerging trends and patterns in lending behavior, while simultaneously improving its predictive capabilities.

Technical Foundations for AI Integration

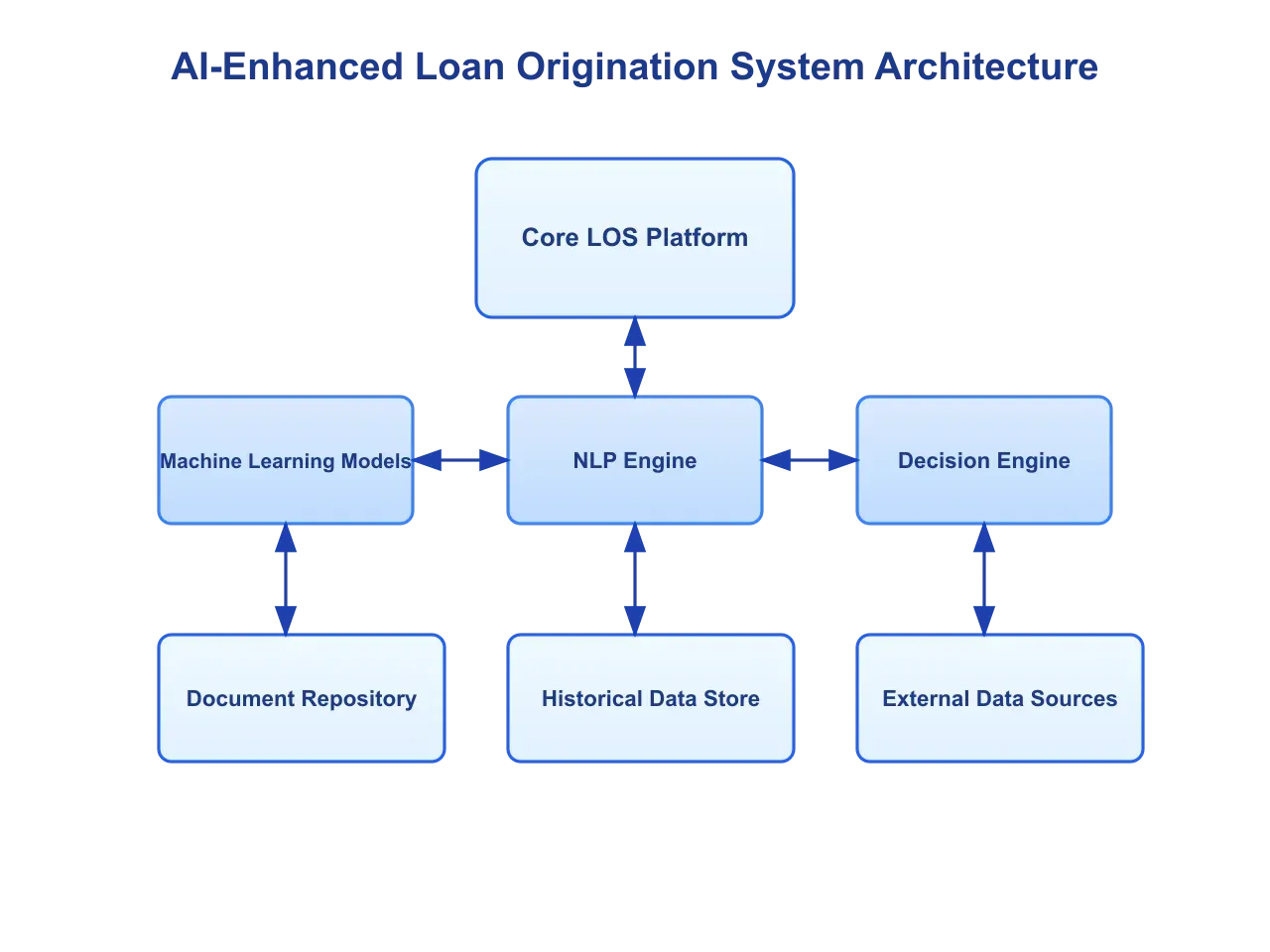

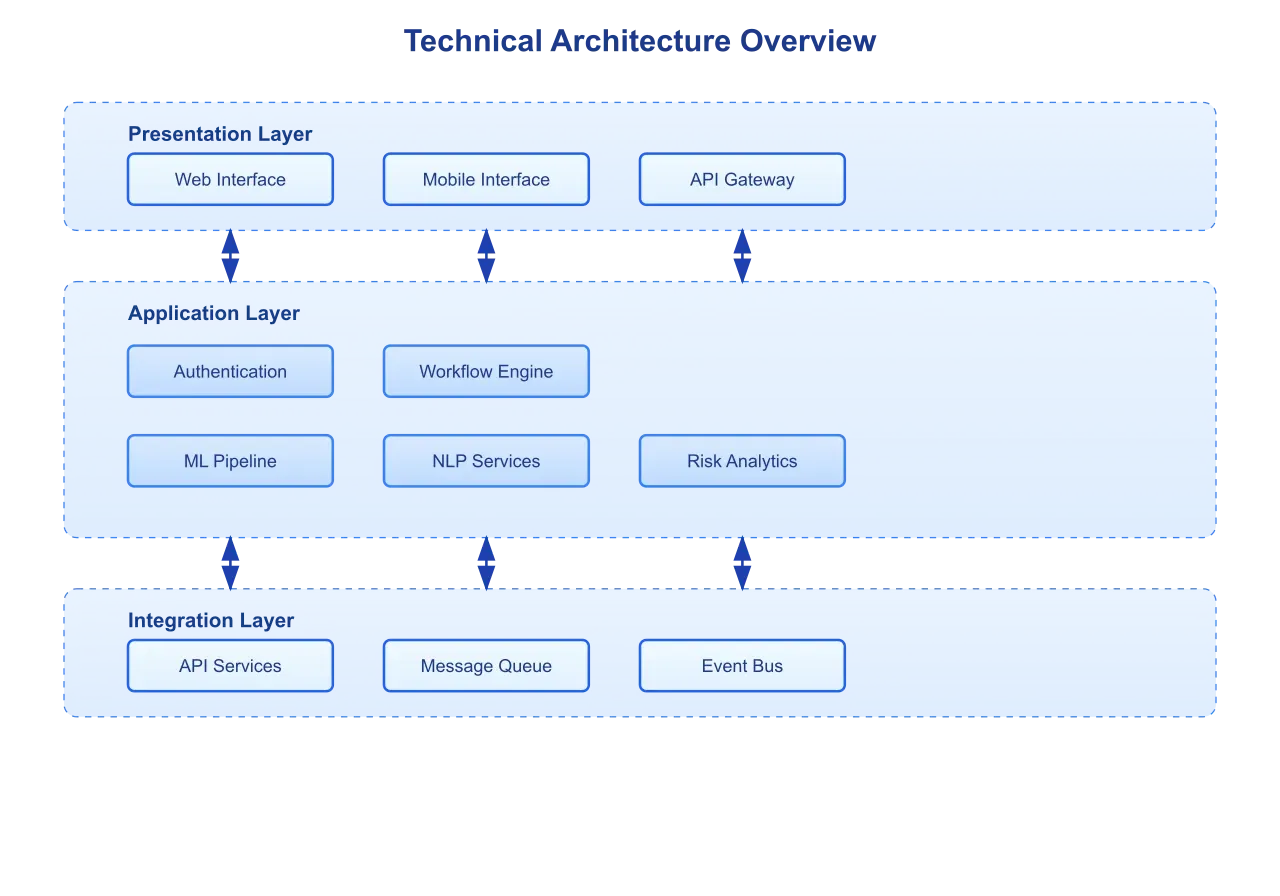

The successful integration of AI capabilities with existing LOS platforms requires a robust technical foundation that addresses both architectural and operational considerations. This foundation must support seamless data flow, maintain system security, and ensure regulatory compliance while enabling the AI components to function effectively. The complexity of this integration necessitates a carefully planned approach that considers all aspects of the system's operation.

A robust data infrastructure forms the cornerstone of successful AI integration, serving as the foundation upon which all advanced capabilities are built. This infrastructure must enable high-volume data processing while maintaining the integrity and security of sensitive financial information. Real-time data access and analysis capabilities are essential for supporting dynamic decision-making processes, while secure data storage and transmission mechanisms protect sensitive financial information throughout its lifecycle. The infrastructure must also support standardized data formats and protocols to ensure smooth communication between different system components, while simultaneously maintaining the flexibility to integrate with external data sources that enhance the system's analytical capabilities.

Modern API architectures play a crucial role in facilitating smooth communication between AI components and existing LOS functions. The implementation of RESTful APIs and microservices architectures provides the necessary flexibility and scalability for effective integration while maintaining system stability and security. This architectural approach enables modular system development and updates, allowing institutions to incrementally enhance their capabilities while minimizing disruption to existing operations.

The processing capabilities required for AI-enhanced loan origination represent a significant advancement over traditional systems. Complex machine learning model execution demands substantial computational resources, while real-time data processing and analysis capabilities must support the concurrent processing of multiple loan applications. The system must intelligently allocate resources based on workload, ensuring optimal performance during periods of peak demand while maintaining cost-effectiveness during normal operations.

Implementation Strategies and Operational Considerations

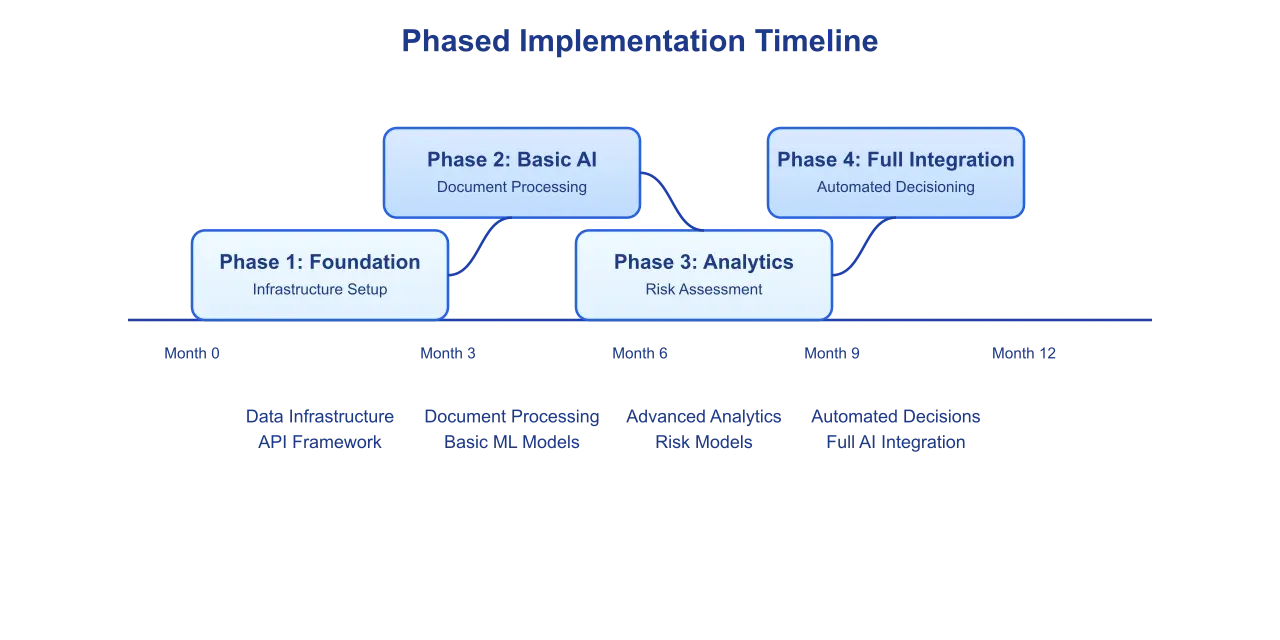

Phased Integration Approach

The implementation of AI capabilities within an existing LOS environment requires a carefully orchestrated approach that balances innovation with operational stability. Financial institutions must consider the complexities of integrating sophisticated AI systems while maintaining their current lending operations. A phased integration strategy has emerged as the most effective method for achieving this balance, allowing organizations to systematically enhance their lending capabilities while minimizing disruption to existing processes.

The initial phase typically focuses on implementing foundational AI capabilities that complement existing LOS functionality. This begins with the integration of basic document processing and data extraction capabilities, which serve as the groundwork for more advanced AI applications. Natural language processing algorithms can be deployed to automate the extraction of information from standard loan documents, such as income verification forms, tax returns, and bank statements. This preliminary integration provides immediate operational benefits while establishing the technical framework for subsequent AI enhancements.

Enhanced Data Processing and Analysis

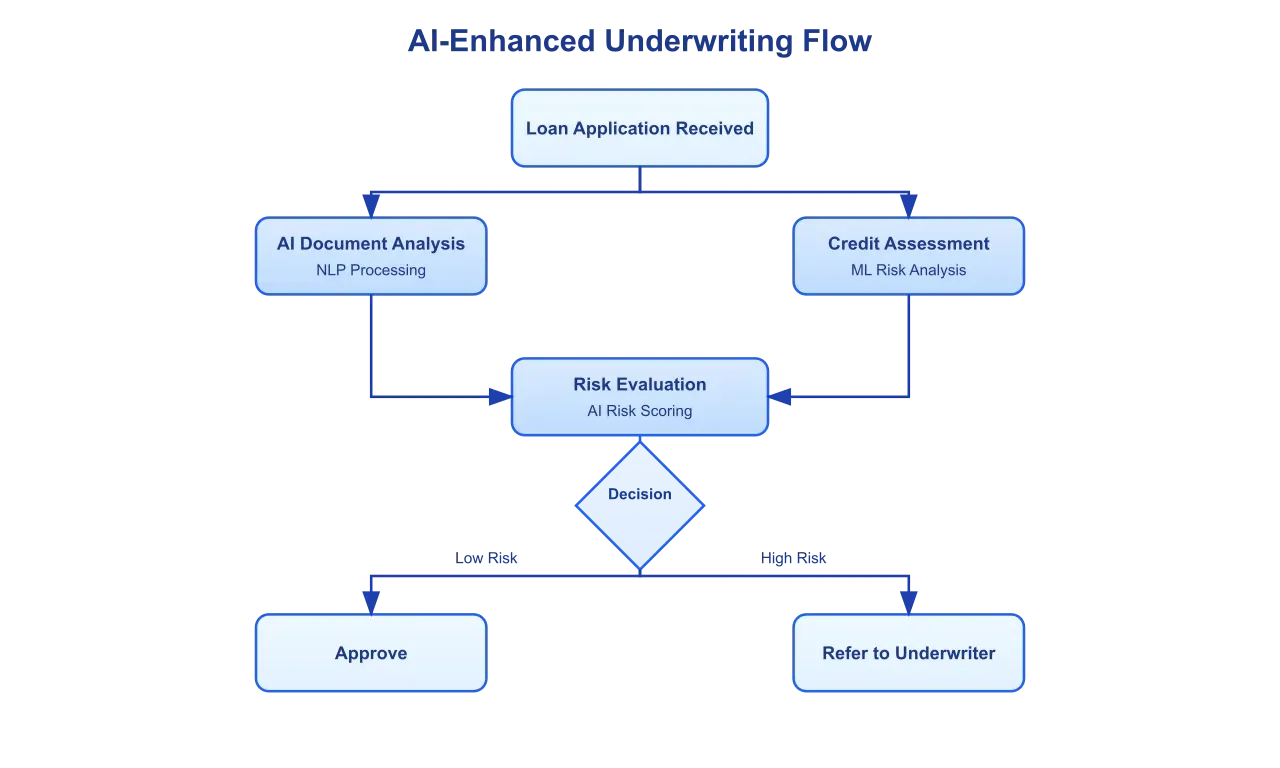

The transformation of raw lending data into actionable insights represents a crucial capability of AI-enhanced loan origination systems. Advanced machine learning algorithms can process vast quantities of structured and unstructured data, identifying patterns and relationships that traditional analysis methods might overlook. This enhanced analytical capability extends across multiple dimensions of the lending process, from initial application processing to final decision-making.

Contemporary AI systems employ sophisticated neural networks and deep learning models to analyze applicant data comprehensively. These systems can evaluate traditional credit metrics alongside alternative data sources, creating a more nuanced understanding of borrower creditworthiness. The integration of machine learning models enables the system to identify subtle correlations between various data points, potentially uncovering valuable insights about loan performance and risk factors that might not be apparent through conventional analysis methods.

Automated Underwriting Enhancement

The integration of AI technologies significantly enhances the underwriting process by introducing advanced predictive capabilities and automated decision-making support. Modern machine learning algorithms can analyze historical loan performance data to identify key risk indicators and predict potential outcomes with greater accuracy than traditional statistical methods. This enhanced analytical capability enables more precise risk assessment and more consistent underwriting decisions.

The AI-enhanced underwriting process leverages multiple data streams to create a comprehensive borrower profile. Beyond traditional credit scores and financial statements, the system can incorporate alternative data sources such as payment history for utilities and rent, business performance metrics, and even social media activity when appropriate and permissible. This holistic approach to risk assessment enables more accurate evaluation of borrower creditworthiness, particularly for applicants with limited traditional credit history.

Regulatory Compliance and Risk Management

The integration of AI capabilities within loan origination systems must carefully consider regulatory requirements and risk management protocols. Financial institutions must ensure that AI-enhanced processes maintain compliance with applicable regulations while providing adequate transparency and accountability. This necessitates the implementation of robust monitoring and control mechanisms that can track AI system decisions and provide clear audit trails.

Modern AI systems incorporate sophisticated compliance monitoring capabilities that can automatically flag potential regulatory issues and ensure adherence to lending guidelines. These systems can analyze loan applications and decisions in real-time, identifying potential compliance violations before they occur. Furthermore, machine learning models can be trained to recognize patterns that might indicate discriminatory lending practices, helping institutions maintain fair lending standards and avoid regulatory scrutiny.

The risk management framework for AI-enhanced lending operations must address both traditional lending risks and new challenges introduced by AI technologies. This includes managing model risk, ensuring data quality and integrity, and maintaining system security. Regular validation of AI models and periodic review of system performance help ensure that the enhanced capabilities continue to meet institutional requirements and regulatory standards.

Performance Monitoring and Optimization

The implementation of AI capabilities within a loan origination system requires continuous monitoring and optimization to ensure optimal performance. Advanced analytics tools track system performance across multiple metrics, including processing speed, decision accuracy, and risk assessment effectiveness. This ongoing monitoring enables institutions to identify areas for improvement and implement necessary adjustments to enhance system performance.

Performance optimization in AI-enhanced systems extends beyond traditional operational metrics to include specific AI-related considerations. Model performance must be regularly evaluated to ensure that predictive accuracy remains high and that the system continues to adapt to changing market conditions. This includes monitoring for potential bias in AI decisions and ensuring that the system maintains fair lending practices across all borrower segments.

The optimization process also involves regular refinement of AI models based on new data and observed performance patterns. Machine learning algorithms can be periodically retrained with updated data sets to maintain their predictive accuracy and adapt to evolving market conditions. This continuous improvement process ensures that the AI-enhanced system remains effective and continues to provide value to the lending operation.

Future Perspectives and Concluding Insights

Emerging Technologies and Future Integration Possibilities

The landscape of AI technology continues to evolve rapidly, presenting new opportunities for enhancing loan origination systems beyond current capabilities. Quantum computing developments may soon enable processing of vastly larger datasets and more complex algorithms than currently possible, potentially revolutionizing risk assessment and decision-making processes in lending operations. These advancements could facilitate real-time analysis of global economic indicators and market conditions, providing unprecedented insight into lending risks and opportunities.

Edge computing integration represents another frontier in AI-enhanced lending systems. The ability to process data closer to its source could significantly reduce latency in loan processing while improving security and compliance capabilities. This distributed processing approach could prove particularly valuable for financial institutions with geographically dispersed operations, enabling more efficient processing of local market data while maintaining centralized control and oversight.

Natural language processing capabilities continue to advance, suggesting future systems may achieve near-human levels of comprehension when analyzing loan documentation. This evolution could eventually enable fully automated processing of complex loan applications, including the ability to understand and evaluate narrative explanations of financial circumstances that current systems struggle to assess. The integration of advanced NLP capabilities could also enhance customer interaction through sophisticated conversational interfaces that provide personalized guidance throughout the loan application process.

Organizational Impact and Change Management

The successful integration of AI capabilities within existing loan origination systems requires careful consideration of organizational impacts beyond technical implementation. Financial institutions must develop comprehensive strategies for managing the cultural and operational changes that accompany technological advancement. This includes addressing concerns about job displacement while highlighting opportunities for staff to develop new skills and take on more strategic roles in the lending process.

Training and development programs play a crucial role in preparing staff for the AI-enhanced lending environment. Loan officers and underwriters must learn to work effectively with AI systems, understanding both their capabilities and limitations. This knowledge enables staff to leverage AI insights effectively while maintaining appropriate human oversight of lending decisions. Furthermore, institutions must develop new expertise in areas such as model risk management and AI system maintenance, creating opportunities for career advancement within the organization.

The transformation of lending operations through AI integration also necessitates changes in organizational structure and governance frameworks. Traditional hierarchies may need to evolve to accommodate new roles and responsibilities related to AI system management and oversight. Additionally, institutions must establish clear protocols for resolving conflicts between AI recommendations and human judgment, ensuring that decision-making processes remain transparent and accountable.

Scalability and Market Adaptation

The scalability of AI-enhanced loan origination systems represents a critical consideration for financial institutions operating in dynamic market environments. The architecture of these systems must support both horizontal and vertical scaling to accommodate growing transaction volumes and expanding market opportunities. This scalability extends beyond mere processing capacity to encompass the system's ability to adapt to new market conditions and emerging lending opportunities.

Market adaptation capabilities become increasingly important as financial institutions expand into new lending markets or introduce innovative loan products. AI systems must demonstrate sufficient flexibility to accommodate varying regulatory requirements across different jurisdictions while maintaining consistent risk management standards. The ability to quickly adjust underwriting criteria and decision-making parameters enables institutions to respond effectively to changing market conditions and competitive pressures.

Conclusion

The integration of artificial intelligence with existing loan origination systems represents a fundamental transformation in lending operations, offering unprecedented opportunities for efficiency, accuracy, and innovation in loan processing. This comprehensive analysis has explored the multifaceted nature of this integration, from technical foundations through implementation strategies to future possibilities. The success of AI integration initiatives depends not only on technical excellence but also on careful attention to organizational and operational considerations.

Financial institutions embarking on this transformation journey must maintain a balanced approach that addresses both immediate operational needs and long-term strategic objectives. The phased implementation strategy discussed in this analysis provides a framework for managing this complex transition while maintaining operational stability and regulatory compliance. Continuous monitoring and optimization of AI-enhanced systems ensure sustained performance improvement and adaptation to evolving market conditions.

As artificial intelligence technologies continue to advance, the potential for further enhancement of loan origination systems remains substantial. Financial institutions that successfully navigate the challenges of AI integration while maintaining focus on operational excellence and regulatory compliance will be well-positioned to capitalize on emerging opportunities in the lending market. The future of loan origination lies in the effective synthesis of artificial intelligence capabilities with human expertise, creating lending operations that are more efficient, accurate, and responsive to borrower needs than ever before.